When it comes to buying a home, most people focus on location, budget, and property size. But there’s another factor that plays a powerful role in making property more affordable—the repo rate. It might sound like a technical banking term, but understanding the repo rate’s impact on real estate can help you make smarter decisions as a first-time home buyer or a seasoned investor.

In this blog, we’ll break down what the repo rate is, how it influences home loan interest rates, and why a low repo rate is good news for real estate buyers.

What Is the Repo Rate?

The repo rate, or repurchase rate, is the interest rate at which a country’s central bank (in India, that’s the Reserve Bank of India or RBI) lends money to commercial banks.

When the RBI lowers the repo rate, borrowing becomes cheaper for banks. This leads to lower home loan interest rates for consumers like you.

How the Repo Rate Impacts Real Estate

1. Cheaper Home Loans

A lower repo rate reduces the cost for banks to borrow funds. In turn, banks often pass these savings to customers through reduced mortgage rates or home loan interest rates. This makes financing a home more affordable and attractive.

2. Boost in Housing Demand

When EMIs go down, more people are encouraged to buy homes. This leads to increased demand in the housing market, especially in affordable housing and mid-income residential projects.

3. Real Estate Growth

A favorable lending environment can revive sluggish real estate markets, encouraging developers to launch new projects and offer discounts, flexible payment plans, or other buyer-friendly schemes.

Benefits of Lower Repo Rates for Home Buyers

1. Lower EMIs, Higher Savings

One of the biggest advantages of a lower repo rate is reduced EMIs. Whether you’re taking a new loan or switching lenders, a drop in the repo rate means you pay less each month, freeing up cash for savings or investments.

Example: On a ₹50 lakh loan over 20 years, a 1% drop in interest can save you over ₹6 lakh in total interest paid.

2. Easier Entry Into Home Ownership

When borrowing is cheaper, the path to owning your first home becomes easier. Banks may also increase your loan eligibility, allowing you to buy a better property without stretching your budget.

3. Switch from Renting to Owning

In low interest-rate environments, many people find their EMI is close to what they were paying in rent. This makes owning a home more practical and financially sound.

4. Potential Appreciation in Property Value

As more buyers enter the market due to affordable loans, real estate demand increases. Over time, this can lead to property price appreciation, giving you capital gains on your investment.

Real-World Example: Repo Rate Cuts During COVID-19

During the pandemic, the RBI aggressively cut the repo rate to support the economy. The repo rate fell to a historic low of 4.00%, resulting in record-low home loan interest rates. This move triggered a wave of real estate buying across India, especially in cities like Pune, Hyderabad, and Bengaluru. Developers offered discounts, and banks rolled out competitive loan offers, making it a golden period for homebuyers.

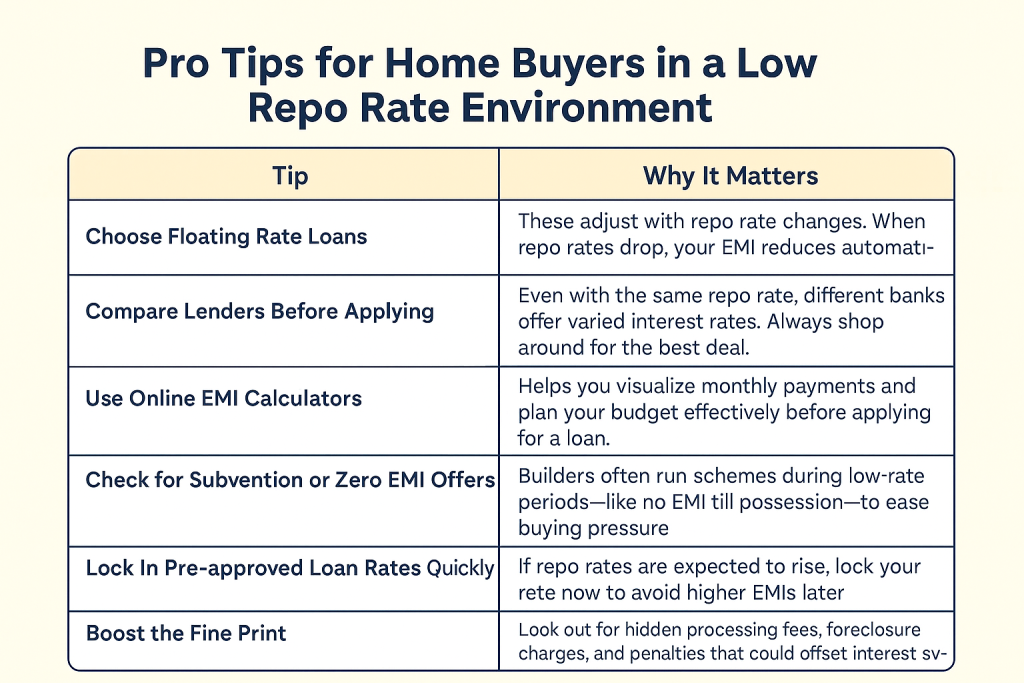

Pro Tips for Home Buyers in a Low Repo Rate Environment

| Tip | Why It Matters |

| Choose Floating Rate Loans | These adjust with repo rate changes. When repo rates drop, your EMI reduces automatically. |

| Compare Lenders Before Applying | Even with the same repo rate, different banks offer varied interest rates. Always shop around for the best deal. |

| Use Online EMI Calculators | Helps you visualize monthly payments and plan your budget effectively before applying for a loan. |

| Check for Subvention or Zero EMI Offers | Builders often run schemes during low-rate periods—like no EMI till possession—to ease buying pressure. |

| Lock In Pre-approved Loan Rates Quickly | If repo rates are expected to rise, lock your rate now to avoid higher EMIs later. |

| Read the Fine Print | Look out for hidden processing fees, foreclosure charges, and penalties that could offset interest savings. |

| Boost Your Credit Score | A higher score qualifies you for the lowest possible interest rates, making your home loan even cheaper. |

Repo Rate Trend in India (2020–2025): What Home Buyers Should Know

Understanding the repo rate history is crucial if you’re planning to buy a home, invest in real estate, or simply stay updated on home loan interest rate trends in India. The repo rate, set by the Reserve Bank of India (RBI), plays a key role in determining how affordable your future home loan will be.

Let’s take a closer look at how the RBI repo rate has changed over the past five years and what it means for you as a home buyer or real estate investor.

RBI Repo Rate History (2020–2025)

| 📆 Date | 💰 Repo Rate | 🔄 Change | 📌 Why It Changed |

|---|---|---|---|

| April 2025 | 6.00% | 🔻 -0.25% | RBI cut rates to boost consumption and revive housing demand amid declining inflation. Great time for home loan applicants. |

| February 2025 | 6.25% | 🔻 -0.25% | Continued efforts to make borrowing cheaper. Encouraged first-time home buyers to enter the market. |

| December 2024 | 6.50% | ➖ No Change | RBI maintained rates to observe the economy’s post-pandemic behavior. Real estate remained steady. |

| February 2023 | 6.50% | 🔺 +0.25% | Repo rate hiked to manage high inflation, which caused home loan rates to increase slightly. |

| December 2022 | 6.25% | 🔺 +0.35% | An upward revision due to inflationary concerns and currency volatility. EMIs started rising. |

| June 2020 – March 2022 | 🔽 4.00% (Stable) | 🚨 Pandemic Low | During COVID-19, the RBI slashed the repo rate to an all-time low of 4.00%, triggering a real estate boom with record-low housing loan rates. |

What This Means for Home Buyers

When the Repo Rate Falls…

- Home loan interest rates decrease

- EMIs become more affordable

- Real estate demand increases

- Best time to buy your first home or invest in affordable housing projects

When the Repo Rate Rises…

- Loans become costlier

- EMIs go up

- Property affordability takes a hit

- Good time to refinance existing loans if fixed-rate options are available

Final Thoughts: Should You Buy a Home When Repo Rates Are Low?

Absolutely! If you’ve been waiting to enter the housing market, a low repo rate environment offers the perfect opportunity. With reduced EMIs, higher affordability, and long-term investment potential, now is a smart time to take that leap toward homeownership.

However, timing matters. Repo rates don’t stay low forever. As the economy heats up, the RBI may hike rates to control inflation. So, if you’re serious about buying property, now might be your window of opportunity.

Pro Tips for Home Buyers in a Low Repo Rate Environment

Tip: If you’ve been waiting to buy a home, a low repo rate environment might just be your golden opportunity.